Most advisers are confident they have already put processes in place that will enable them to fulfil the demands of the new consumer duty.

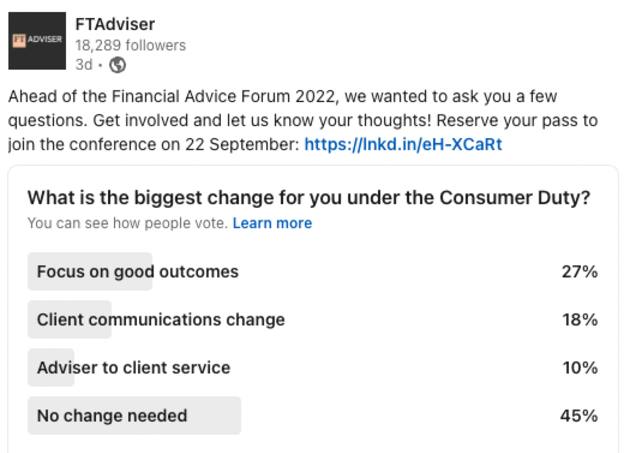

According to a poll among FTAdviser readers, 45 per cent do not think they will need to make any changes under the Financial Conduct Authority's consumer duty regulation.

Some 27 per cent said they would need to ensure they are fully focused on good consumer outcomes, while 18 per cent said they would have to change their communication processes.

Only 10 per cent felt the adviser-client relationship and service levels would have to change as a result of the incoming regulation.

The poll, carried out ahead of FTAdviser's Financial Advice Forum, which returns as an in-person conference on September 22 in Bracken House, London, asked what would be the "biggest change" to advisers and their businesses as a result of the rules.

As reported by FTAdviser in July, the FCA said it would be giving firms an additional three months to implement the new consumer duty rules.

In a policy statement published on July 27, the FCA announced companies will have until July 31, 2023 to implement the consumer duty rules for all new and existing products and services that are currently on sale.

The City watchdog said clarity on its expectations, alongside firms focusing on what their customers need, should lead to more flexibility for firms to compete and innovate in the interests of consumers.

The duty will include requirements for firms to:

- end rip-off charges and fees;

- make it as easy to switch or cancel products as it was to take them out in the first place;

- provide helpful and accessible customer support, not making people wait so long for an answer that they give up;

- provide timely and clear information that people can understand about products and services so consumers can make good financial decisions, rather than burying key information in lengthy terms and conditions that few have the time to read;

- provide products and services that are right for their customers; and

- focus on the real and diverse needs of their customers, including those in vulnerable circumstances, at every stage and in each interaction.

FTAdviser will be talking in more depth with a host of industry experts about the consumer duty and other regulation at our upcoming Financial Advice Forum.

To book your free place, visit the events page here.