"The benefits derived from the adoption of blockchain technologies will help to fortify our ageing financial services backbone."

Gerry Sachs, financial services regulatory attorney at Venable LLP, says this will only grow as open banking becomes the expectation of businesses and consumers looking for clean, streamlined, branchless banking concepts.

"Blockchain is not hampered by issues that stem from legacy technology systems. Importantly", he says, "it provides a clean technological base from which to build innovative products, and it is more flexible relating to development and use."

Registering ownership, transfers and escrow

For many advisers, insurers, pension funds, discretionary fund managers and anyone involved in financial services, the fact Blockchain has the potential for the secure storage of digital records is also a boon.

At present, because of its distributed nature, recording new assets on a blockchain can be quite slow, compared with the seconds or even nano-second that are typical of e-commerce. Consider the high latency of exchanges such as the London Stock Exchange, and compare this to the slow transaction times of blockchain, which can sometimes take hours or even days to record new assets.

But as firms build on this and develop it, the speed of registration will improve significantly.

Although it is not available currently, blockchain could be used to document financial transactions, such as mortgages, or to store compliance information for processes such as know your client and anti-money laundering compliance.

"If I can do a remittance payment with someone in Eastern Europe in minutes, compared with days in the traditional banking system", says Philipp Pieper, chief executive of Swarm Fund, "that is compelling and appealing."

Property, financial derivatives and even international financial transactions might also be a beneficiary of blockchain.

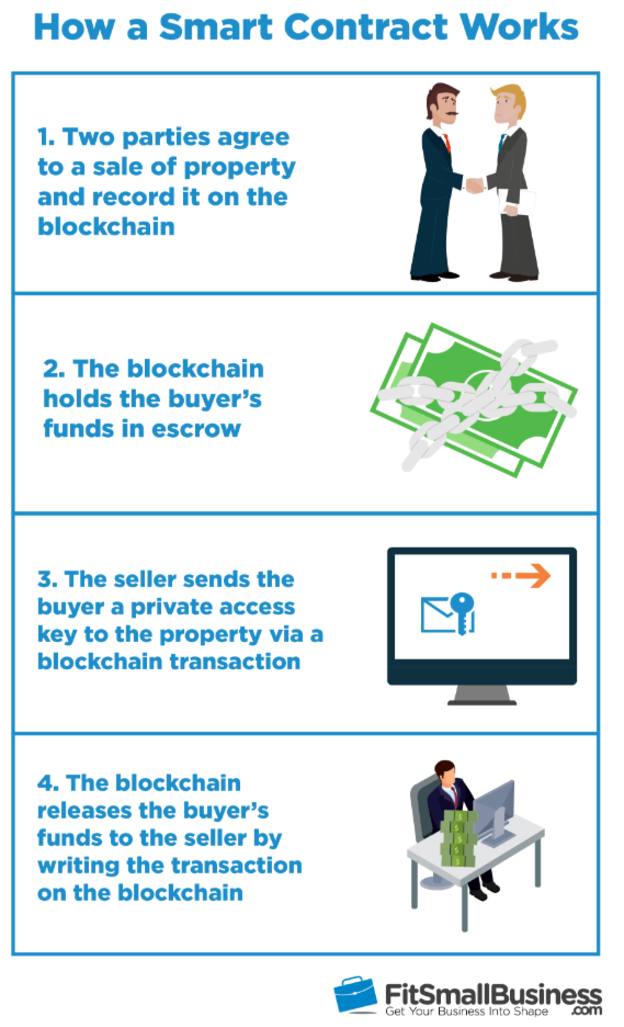

For example, smart contracts - such as the ones operating on Ethereum's blockchain - hold more than the register of the ownership of an asset.

This means the smart contract registers the full contractual terms of a transaction, and therefore can act as a distributed escrow agent, as well as a distributed property register.

Although recently mortgage lenders have been refusing to accept deposits made from investments in cryptocurrency - because they are not able to prove the money has come legitimately and not the by-product of money laundering somewhere down the virtual line - the theoretical use of blockchain in enabling quicker, smoother and easier property purchases marks a significant step forward in making transactions better for the end consumer.