To help advisers narrow down the field, individual funds and multi-asset portfolios often come with risk and suitability ratings by agencies that can help the adviser make a more tailored decision about the suitability of the multi-asset fund (or the discretionary fund manager to whom the investment decisions are outsourced).

These can also help advisers assess whether the initial client portfolio construction, suitability of portfolio selection and suitability of transactions to portfolio mandate will be the right fit for the client.

For example, Defaqto has introduced suitability ratings for income funds, which puts the fund into one of four different risk categories based on the income versus capital volatility trade-off.

Such tools, although not the be-all-and-end-all to an adviser, can also assist in the ongoing assessment of portfolio risk and suitability, as markets' and clients' financial situations change.

Challenges

For Mr Morris, the way in which the investment world seems to be moving can present a challenge for advisers when trying to mitigate risk and maintain a well-balanced, diversified and risk-appropriate multi-asset portfolio.

He explains that, as people have been chasing income for many years - even more so perhaps since the 2008 financial crisis - spreads on fixed income have narrowed and dividend growth in equities has become tougher to find, as everyone is hunting in the same grounds.

He says: "Increased correlation of equities and bonds is a concern."

Correlation is indeed a concern. According to Rathbones' multi-asset team, maintaining a focus on correlation is important for a fund manager when it comes to portfolio construction and management, as well as for an adviser keeping watch to ensure ongoing suitability.

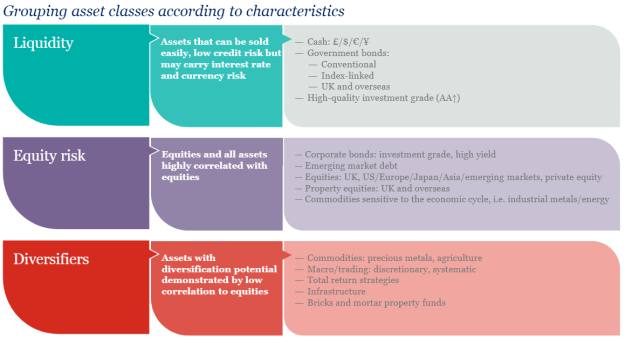

The below graphic illustrates some of the risks inherent in each of the main asset classes within a multi-asset portfolio, which need to be managed accordingly.

Source: Rathbones

Discussing risk

While understanding all these risks and mitigating these can be a challenge, Bob Szechenyi, investment director for Rathbones, says it can be done - and the key to manage these is by really knowing your client.

He says: "This can be achieved through a combination of qualitative and quantitative approaches.

"Ultimately it is about knowing your client, understanding their overall circumstances and their life goals, through discussions, risk questionnaires and risk profiling, in order to ascertain that the strategy and risk tolerance are the right fit."

Joe Roxborough, chartered financial planner for Ascot Lloyd, agrees, but cautions the conversation has to be clear for the client to understand.

"The very first step in discussing risk", he says, "is to operate with a shared language that both parties understand.

"I see a lot of discussion about cautious, balanced, growth and adventurous models, but in most circumstances these are loosely, if at all, defined."