"The companies providing these risk profilers have approached fund providers and, in a commercial venture, have mapped multi-asset funds to their risk outcomes."

Once the funds have been through the process, which is monitored on an ongoing basis to ensure the fund is continuously risk rated (which had been an issue raised in previous years by the FCA), the fund can then be badged with the risk profiler's outcome.

Mr Willis says: "As a result, all of those advisers who use that risk profiler for their clients can then select from the multi-asset funds that fit with the same risk outcome."

Assessing suitability

For Chris Leyland, deputy chief investment officer for True Potential, selecting the right multi-asset fund for clients is far more than carrying out a simple risk versus reward assessment.

He comments: "It is vital to understand the clients’ expectations and needs, summarised as their investment goals. From there it is important to work out how you feel the fund will perform in differing market conditions."

He gives a list of questions to help decide whether a particular multi-asset portfolio will be suitable for any one client. These are:

- Can it offer something different to a traditional equity:bond fund?

- Does it hold assets that are lowly correlated or even uncorrelated to equity markets?

- How does the manager control risk?

- What is their currency exposure and how is this managed?

- What is the manager’s investment process?

- Does the fund give the client value for money?

Peter Sleep, senior investment manager for Seven Investment Management, says selecting the right multi-asset fund for a client is "usually the first thing a good financial planner does, and it is absolutely a regulatory requirement".

According to Mr Sleep: "A planner will usually have a questionnaire for clients to fill in, which will help the planner guide the client to the right balance of risk and return, and understand what the client is willing to lose."

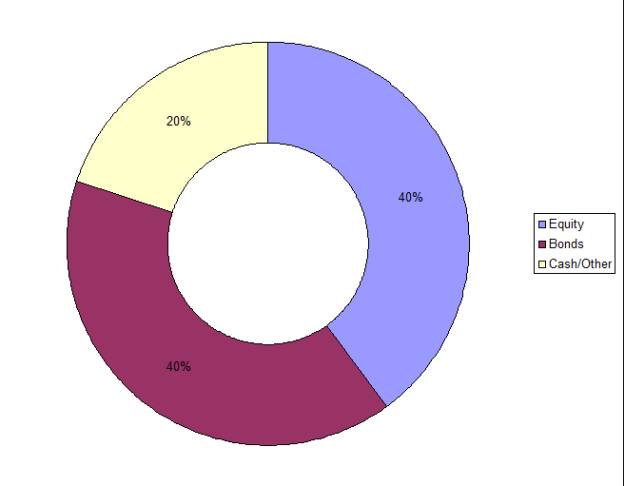

Usually, Mr Sleep adds, the most popular funds tend to be the 'balanced' funds in a multi-asset fund range, which are broadly comprised of an equal weighting of bonds and cash, as the pie chart below shows.

Typical breakdown of a balanced fund

Source: Seven Investment Management

"As a rule of thumb, the more the equity, the greater the risk," Mr Sleep states. "If clients are not happy with a large drop in one's investments, and find they cannot sleep at night when this happens, then they could go for a fund with very little equity content."

The investment horizon and the investment outcome

Rules of thumb aside, for Seven Investment Management, there is no 'grey' area when it comes to fund selection and assessing suitability, regardless of whether the client has answered enough questions to be categorised by a risk-profiling tool into a particular investor profile.

His colleague Chris Justham, relationships manager, says this sort of fact-find to assess an individual's objectives and risk tolerance acts as the first stage of a screening process. What also matters is understanding what the manager's process is and how this might fit with the client's own objectives and tolerance.