The provision of infrastructure across developed and emerging market countries is increasing.

Basic infrastructure needs still have to be met in many of the less developed economies, whether that is infrastructure delivering clean water to millions of homes, or roads and bridges connecting otherwise previously isolated areas.

In much of the developed world, maintaining current infrastructure is necessary as it takes the strain under burgeoning populations, at the same time as meeting demand for new types of infrastructure.

Jason Hollands, managing director, business development and communications at Tilney points out: “Governments in the developed world are also increasing their spend on infrastructure to try and boost growth and efficiency after years of relying excessively on the tools of monetary policy, such as low interest rates, to support their economies.”

In 1950, only 30 per cent of the world’s population was living in urban areas, but by 2050, 66 per cent of the world’s population is projected to live in urban areas, according to Legg Mason Global Asset Management.

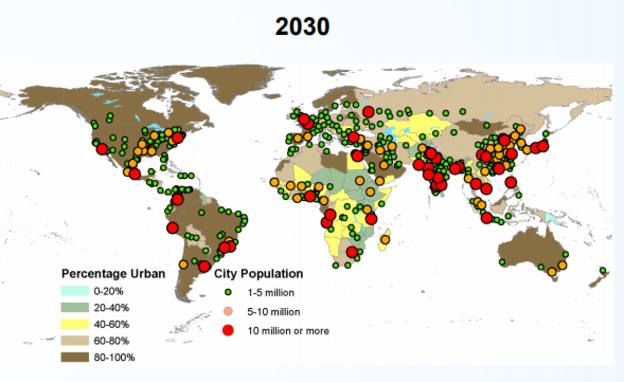

According to research collated by Legg, taking into consideration information from the United Nations' Department of Economic and Social Affairs, there will be a growth in mega-cities across the globe.

The research shows that while in 2014 there were 28 megacities (defined as those with a population greater than 10m), in 2030, there are projected to be 41 megacities.

Figure 1: Urbanisation and population growth in 2030

Source: United Nations Department of Economic and Social Affairs, Population Division, World Urbanization Prospects 2014 – Percentage urban and urban agglomerations by sizeclass / Legg Mason Global Asset Management

Given the projections for economic and population growth, it is understandable why many advisers and their clients have correctly identified the investment opportunity in the infrastructure sector.

Traditional exposure

Deciding how to get that exposure, whether through listed or unlisted infrastructure, is likely to depend on an investor’s risk and reward appetite but also on the different characteristics each asset class displays.

As Peter Meany, portfolio manager of the First State Global Listed Infrastructure fund establishes: “Infrastructure describes the physical assets that provide basic services to modern society, including utilities, transport and communication assets.

“Listed infrastructure is the term used to describe publicly-listed companies that own or operate this type of asset.”

He suggests that, traditionally, exposure to infrastructure has been achieved by investors using unlisted infrastructure funds, “which buy direct stakes in infrastructure assets and can often have a say in their operational management”.

“Listed infrastructure funds, which consist of a portfolio of listed infrastructure company shares, now provide an alternative way for investors to gain exposure to the same type of underlying assets,” Mr Meany notes.

Mr Hollands observes at a time when global spend on infrastructure development is forecast to increase significantly over the next decade, it is important for potential investors to understand how listed infrastructure differs from unlisted infrastructure.